February 2010 saw a major bun fight between Amazon, perhaps the most significant channel to market, and Macmillan one of the foremost Publishers. The ins and outs of what happened when are widely reported and blogged elsewhere; so I'll not re-type all that again here. This was a high stakes poker game for control of pricing in the emergent eBook market, in which Amazon may have overplayed their cards and had their bluff called. This will become an interesting case study for students of marketing.

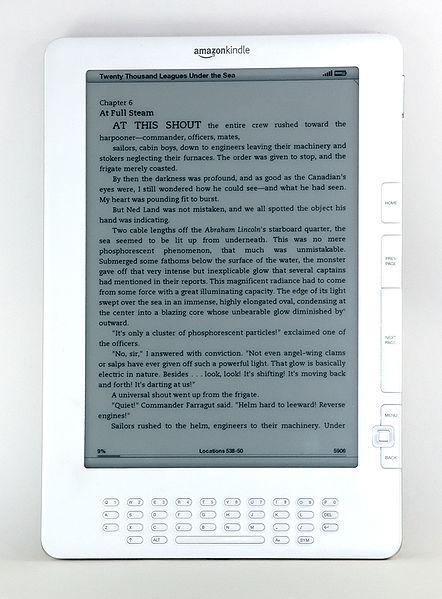

Amazon were trying to establish a vice like control over pricing in the market through what they perceived to be their domination of the channel to market. Yes it was in fact Amazon being 'the bully' rather than Macmillan; though many called it differently. Why shouldn't Amazon take this stance? After all, this model worked fine for Apple in the eMusic market where a they managed to establish a $0.99 per track price position through exclusive control of the channel to market, and which Amazon has most likely benefited from since. The fact that the eBook is an emerging market, and that the market position of the Kindle is somewhat akin to that of the early iPod, makes fixing a $9.99 eBook price position an attractive strategy for Amazon to pursue. If they won this pricing battle they would insulate themselves from a great deal of the uncertainty of price elasticity for some time, and be in a position of control over their suppliers. An attractive, almost irresistible goal for Amazon.

Publishers provide an important service to authors, they invest in the author's book sinking cost in editing, artwork, layout/typesetting, publicity, distribution and sometimes an up front commission (yes, I know that there's a groundswell of opinion that publishing is dead in the age of the Internet, but that's a separate argument for another time). For publishers as much as any other manufacturer, the route to market is a major factor in the profit available from their goods (some of which pays the authors). The more control the channel to market has, the less control over profitability the manufacturer has.

For Macmillan it was vital that they control the price of their goods rather than Amazon. They seem to have won an important battle in retaining that control, setting the right precedent for both themselves and perhaps for other publishers. This however is by no means the end of the game; both sides it seems to me have unsustainable pricing policies.

Even if Macmillan hadn't won this battle, Amazon would not be able to sustain their fixed price position. There are two factors that work against them: They are not as unassailable as Apple were with their iTunes offer, they don't really have enough of a head start over other players in this eBook market. And secondly the eBook product currently doesn't have such a compelling advantage over the alternative printed versions as the digital music formats had over the compact disc. I don't believe eBooks will, in the short term, become the dominant media choice the way that download music has.

Macmillan have the sense to realise that price elasticity can be used to maximise profits, recognizing that there's a difference in perceived value between the latest hot book and their back catalogue (something that the music industry continually fail to realise). That said, they also seem to believe that the value of an eBook matches that of the print alternative, which I'd argue is currently a false assumption (here's another topic in its own right). In the short term whilst the cost of the eBook readers is limiting the market to (or targetted at) the early adopters, this pricing strategy is just about workable. Sustaining this pricing policy in the long term will either stifle the market with readers continuing to buy print in preference, or they will loose share to other more aggressive ePublishers.

This is an emerging market that will be entertaining to watch, this is the first of many interesting skirmishes, whilst Amazon have lost this battle they won't be giving ground too easily, after all this market has the potential to become a hugely more significant segment of their business.

No comments:

Post a Comment